Odoo Firearms ERP

Odoo Firearms ERP

Manually completing tasks is a time-consuming process. Modernization and technology have allowed businesses to centralize their islands of information as well as automate their daily operations. This tactic has proven useful to companies across all industries – increasing efficiency and reducing costs and labor across the board – and the firearms industry is no exception.

As a defense manufacturer, or even supplier, managing products, and customers and following compliance efficiently is imperative. As such, companies within the arms and ammunition industry require a type of automation software that can not only keep their data safe but also ease their compliance processes. Essentially, a well-rounded business management software is needed — and that’s where Odoo comes into play. An Odoo Firearms ERP software can help businesses within this vertical safeguard and manage their operations efficiently.

So what else can this Odoo Firearms ERP software do for your company?

Generate Unique Serial Numbers

Since recording, tracking, and managing assembly parts and products in an efficient manner is key for those within the firearms industry – Odoo can help with that. You can easily record the parts within a particular assembly. Additionally, using Bista Solutions’ serialization customization, you can give every product part a unique serial number according to its quantity. This unique serialized number can also be used to identify any problems affecting the final product. This Odoo firearms ERP makes identification and tracking, along with management a breeze. Beyond the serialization, Odoo allows you to create a logbook where you can input the unique serial number, weapon type, model, weapon caliber, and customer delivery address. Odoo is basically a complete and compact solution.

- Integrate Odoo Firearms ERP with NFA Tools

NFA Tools is a platform that allows you to streamline the process of creating NFA forms with their web-based tools. Using the unique serial numbers created by Odoo, you can easily generate ATF form records with NFA Tools. Whether it’s a Form 2 for your products of a Form 3, 4, or 5 for shipment based on customer type. NFA Tools and Odoo integrator can help you manage forms in a better manner.

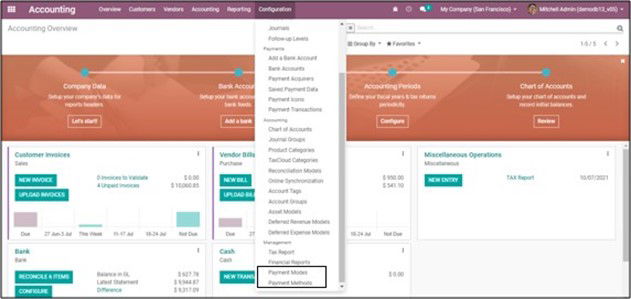

- Track and Fill ATF Forms

The Odoo and NFA Tools integration has other benefits as well. With it, you can track form status as ‘pending’, ‘awaiting approval’, or even as ‘approved’. Once the forms are approved, you can easily attach form-related documents and this will automatically be reflected within Odoo.

- Automate Product Returns with Odoo Firearms ERP

With return request forms, you can easily strengthen your relationship with customers. This return request form requires the request type (serialized item or accessories), the dealer’s information, the serial number along the year of purchase. Odoo Firearms ERP can essentially help you avoid customer duplicates by identifying customer names and merging them with your current customers. This means no duplicate emails, no spam-like content sent out, and all relevant customer information is neatly placed in one area.

- Validate Product Return Serial Numbers

With Odoo, we can integrate your customer support form from your website. This is especially useful if and when your customers need to return items. Our Odoo customization can help you validate the serial numbers for any products that need to be returned by your customers and if the customer’s return request is rejected, Odoo can send an automated email to them explaining why that happened.

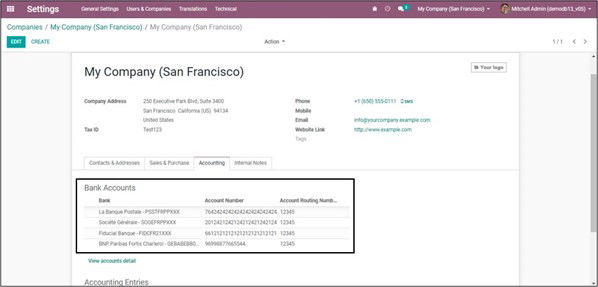

- Integrate WooCommerce with Odoo

Since Odoo apps are built on an open-source platform, Odoo Firearms can easily be integrated with WooCommerce or any other eCommerce platform. Upon this integration, all orders that have been completed in WooCommerce can be found and transferred to Odoo. Once that happens, Odoo will have all the details, including sales order, invoice, and shipment details.

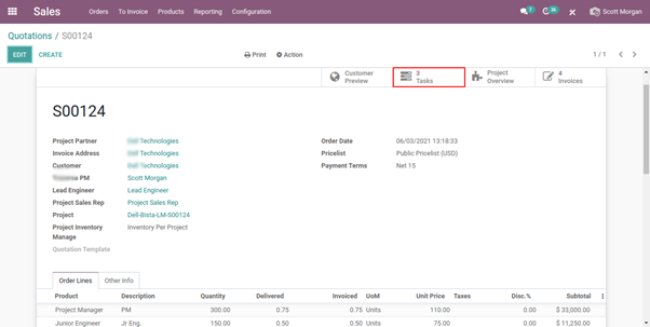

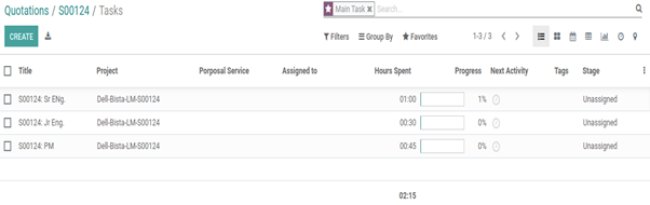

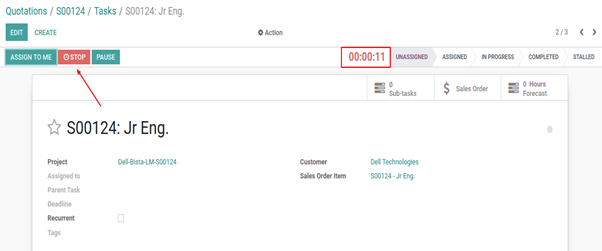

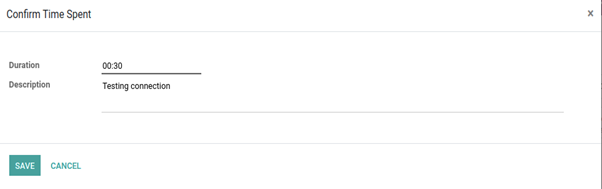

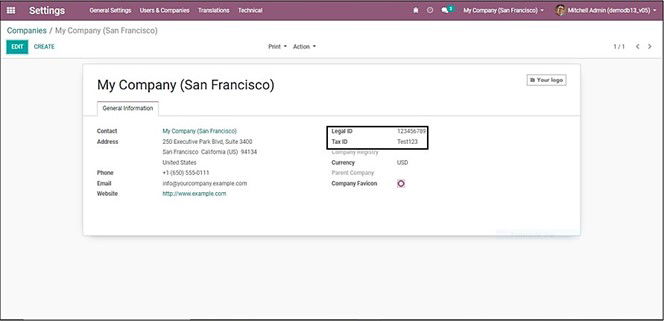

- Validate Sales Order

If the required information for sales orders has expired or is invalid, Odoo will not allow you to create the order. Valid information needs to be inputted before things can move forward to the production or shipment stage of a product order. Odoo can validate customers’ information for you and ensure that shipments and sales orders only go to approved parties after ATF approvals. What’s even better is that Odoo can create a database of denied and approved parties to ensure only ATF-approved customer orders are processed.

- End-to-end Encryption

Odoo Firearms ERP systems like Odoo can be encrypted from end to end to assure safety. This way your work processes and bill of materials are safely stored. This data encryption also protects your product-related data from prying eyes, so that the confidential information regarding raw materials and business operations cannot be seen by unauthorized parties.

In addition to the aforementioned points, an Odoo firearms ERP can do much more than track and manage your inventory. Beyond keeping tabs on your stock-keeping units so you’re aware of how much inventory you have left, it also provides real-time data and stores this information for you to look back on. This can help you make you forecast future sales based on patterns, understand seasonal fluctuations, and market fluctuations, as well as allow you to make financial decisions for the company.

How Bista Solutions Can Help

The team at Bista Solutions knows how critical the operations and regulations in the arms and ammunition industry are. A fully integrated Odoo firearms ERP is key as it allows manufacturers and distributors to manage their compliance, eCommerce, customers, and the overall company. With Odoo’s software strength and Bista’s implementation expertise, you can easily comply with the regulations of your state and avoid any uncertainties in your business.

Take a look at this case study where a firearms company achieved government compliance as well as optimized their business processes with the Odoo firearms ERP.

As a Odoo Gold Partner in the USA, over 250 successful ERP implementations and with sufficient experience within your vertical, you can rest assured our team has you covered. If you would like more information or a free consultation, please connect with us through our contact us form.